Exit Strategy is Business Strategy

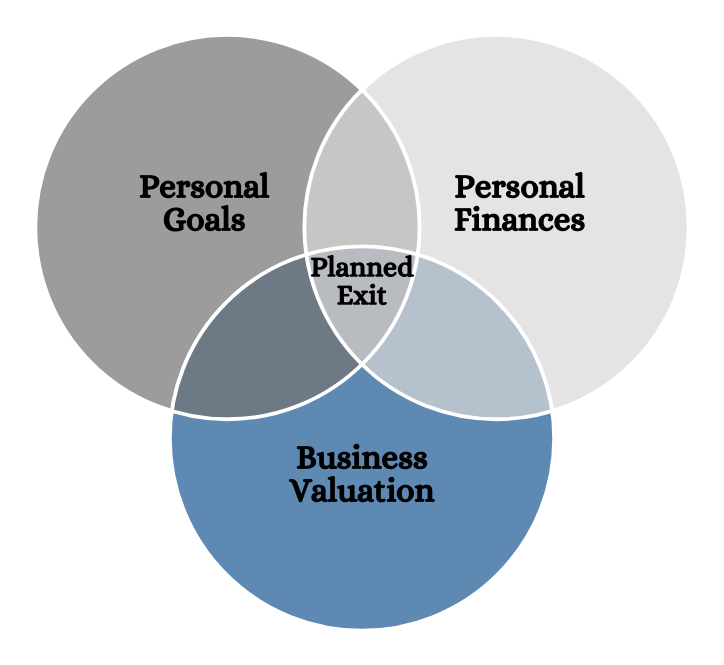

Our Business Exit Strategy process begins with analysis of three, equally important, components for the business owner with the intention to pursue a satisfying exit.

What we provide...

Many business owners invest their time, money, and effort into developing their successful enterprise with the intention that it will be the source of wealth for their families, and possibly, for generations. There are many stakeholders sharing in this success: employees need continuity, communities and charities rely on contributions, suppliers and customers are all impacted. The business owner is the heart of the community. With so many relying on the success and future of the business, the responsibility to exit gracefully is important and deserves focus in the financial plan.

Our Business Exit Strategy process begins with analysis of the three, equally important, components of an exit strategy. The process builds and develops personal goals regarding what to retire to, personal finances and business valuation estimates.

As a business owner, having a Business Exit Plan is Good Business Strategy. Exit planning is a comprehensive strategy that prepares you both personally and financially to exit the business on your terms.

A well designed and implemented exit strategy can help create a clear path for operating your business to one day passing the business along, selling the business or allowing someone to seamlessly operate the business if you are no longer able.

Exiting has a different look for each business owner. Owners who engage in the planning process, will receive a custom-designed road map that integrates the business with financial and personal goals and needs

Like drafting a will, it may be uncomfortable to admit the path is needed but once the process is complete you are relieved you did it on your terms.

Personal Goals and what to retire TO?

“A goal without a plan is just a wish”

-Antoine de Saint-Exupery

A workshop, to create a space in which key people can meet to discuss questions, brainstorm ideas, identify problems, make decisions and develop solutions, are utilized to thoughtfully define, with intent to pursue, the next phase for the business owner and their family, including freedom and peace of mind.

Personal Finances

A holistic approach is taken to align the key pillars of personal financial success.

- Risk Assessment

- Estate Planning

- Financial Planning

- Asset Management

- Business Finances, specifically, how your business supports your personal finances.

Business Valuation, Readiness and Attractiveness

- Business valuation estimate is the key factor that determines the strength of your position when you eventually sell your business.

- Assessments are performed to identify the strengths and weaknesses of the business.

- The main goal is to strengthen the intellectual capital of the business – human, customer, structural and social that would one day be transferred either to a buyer or to family members.

- Total Clarity Wealth Management and LPL Financial do not provide business valuation or legal services. Please consult your legal advisor regarding your specific situation.